Grid stabilization with batteries

Grid scale battery viability

Grid scale batteries - as a stabilizing and smoothing force in the energy grid – are on the rise. Reasons: decreasing battery costs, increased grid congestion, and high energy price volatility.

How can we use our innovation power to build intelligent software for the energy transition?

In the words of Jonathan Kaijser, innovation manager at Itility:

“We are all busy with energy transition. Most emphasis is on hardware and software applications. However, introducing smarter optimization algorithms is still relatively new. And optimization is our area of focus: the balancing act between energy usage, geographical location, timing, energy sourcing, and the comfort level that a person is willing to accept.

Optimizing energy: how?

You can optimize at various levels. For example, at the level of a heat pump within your home in combination with energy prices, tomorrow’s weather and the desired level of charge in your electric car. Or, for example, at the level of energy grid loads in relation to the imbalance energy market.

So, in addition to software and hardware installation projects, modeling and optimizing energy systems is at the heart of what we do. At those different levels.

We have several of those examples running in the real world, and we are already seeing the fruits of that labor: impressive energy savings.”

Are large grid scale batteries financially viable?

An energy retailer approached us with a business case request. He asked to determine the financial viability of large grid scale batteries in the Netherlands. To achieve this, we validated his Excel business case calculation that estimated a payback period of under 5 years. We did so by simulating algorithmic energy trading in multiple energy markets.

The financial viability of the business case depends on:

1. The upfront investment in the battery

2. The price level and price volatility of energy

3. The costs associated with energy trading.

And what about solar arrays?

The energy retailer also requested us to validate a grid battery business case that includes solar arrays. Since, because of grid congestion, the availability of large grid connections has decreased.

Therefor high peak outputs caused by solar arrays are becoming less acceptable.

And this is exactly where batteries can function as a tool to smooth the power output to the grid.

To create a profitable energy trading algorithm, three energy markets were considered.

The first market is the Day-ahead market, which auctions energy the day prior to delivery. At 12:00, the auction closes and defines a market clearance price (MCP) based on all bids. This MCP reflects at what price the buyers and sellers of energy will trade.

The second market is the intra-day market - this allows trading on the day of delivery, up to 5 minutes before delivery (Next-kraftwerke, 2022). Both markets require being a member of, or collaborate with a member of a trading platform, where trade volumes must always exceed 0.1 MW (EpexSpot, Basics of the Power Market, 2022).

The third market is passive imbalance. This market is operated by TenneT, a TSO (Transmission System Operator) in the Netherlands. If a grid frequency of 50 hertz is not maintained, an imbalance is created. Balance Responsible Parties (BSP) get paid to reinstate this balance. Being allowed on this market requires being part of a BSP or being verified as one by TenneT (TenneT, Balancing markets, 2022) (TenneT, List of recognized BSPs, 2022).

Building a trading algorithm

Our solution to the request was to build a trading algorithm that can trade with various energy markets. For this, we created the following infrastructure:

1: We defined generic components such as “Battery” and “Market data”. These represent battery charging characteristics and real historical market data.

2: We built a simulator that can take in battery- and market-data to simulate battery behavior across time. For each time-step, an algorithm runs to determine the action to perform on the battery. This action is run if no charge capacity thresholds are surpassed. These actions and battery charge statistics are tracked in a trading log.

3: We then applied the simulation infrastructure to individual markets, to compute payback periods. Based on the 2022 market data, the passive imbalance market alone is enough to pay for battery purchase costs within a few years.

Based on these initial positive results, the energy retailer is now defining a business plan to utilize large grid scale batteries (potentially in combination with large 1 MW+ solar arrays) to trade energy on the energy markets.

To move forward with the project, the following steps will be taken in the next few months:

• Include Solar arrays into the model (1 MW+)

• Include intra-day market into the model

• Test and integrate the current algorithm at a large Solar array with a real battery

How we did it in more detail

We have operated in 1-week cycles during a quarter, in which we focused on rapidly iterating toward the trading algorithm, while learning all there is to know about the energy markets.

We split the problem into three waves:

1. Modeling each market based on historical data

2. Creating a first real-time trading algorithm

3. Include solar energy in the model, include multiple markets and test on a real battery.

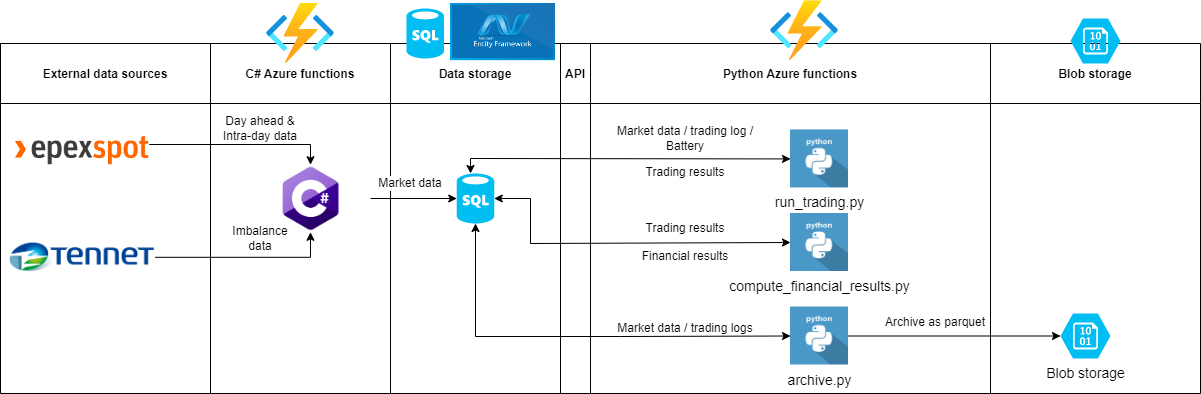

The real-time architecture supports the passive imbalance market, which is currently the most financially lucrative market. The following schematic overview shows the rough outline of the current design:

First, data is read from real market sources and results are stored in SQL. Once new market data comes in, a Python Azure function evaluates what action to take based on the data and the previous charge state of the battery. The results are logged to a table that tracks the battery behavior over time. The following day, profits are computed once the clearance prices are published. Data from the previous day is archived to keep the infrastructure running fast and the cycle continues.

Sources:

- Prices Start to Bite. From https://about.bnef.com/blog/battery-pack-prices-fall-to-an-average-of-132-kwh-but-rising-commodity-prices-start-to-bite/

- Energy, U. D. (2022, 11 28). Learning a better way to oforecast wind and solar energy costs. From https://www.energy.gov/eere/wind/articles/learning-better-way-forecast-wind-and-solar-energy-costs

- EpexSpot. (2022, 11 28). Basics of the Power Market. From https://www.epexspot.com/en/basicspowermarket#day-ahead-and-intraday-the-backbone-of-the-european-spot-market

- EpexSpot. (2022, 11 28). Become a member. From https://www.epexspot.com/en/becomeamember

- Next-kraftwerke. (2022, 11 28). Intra-day trading. From https://www.next-kraftwerke.com/knowledge/intraday-trading

- TenneT. (2022, 11 28). Balancing markets. From https://www.tennet.eu/balancing-markets

- TenneT. (2022, 11 28). List of recognized BSPs. From https://www.tennet.eu/nl/lijst-van-erkende-bsps